TL;DR

The NIPG inventory worth has slumped by greater than 85% since its preliminary public providing in the summertime of 2024.

A lack of $12.7 million was recorded in full-year 2024, though complete revenues have been modestly up year-over-year.

The corporate’s occasion manufacturing operations carried out notably effectively in 2024, whereas esports noticed a decline in revenues.

The corporate is transitioning from a pure esports organisation into a totally built-in gaming‑centric digital leisure platform.

NIP Group believes its entry into the Center East represents a “once-in-a-generation” alternative for gaming and esports.

Traders in NIP Group, the father or mother of esports organisation Ninjas in Pyjamas, have endured a difficult interval for the reason that firm went public final 12 months.

The punishing mixture of considerable losses and a troublesome market backdrop has despatched the NIPG share worth tumbling by greater than 85%.

Nevertheless, the corporate believes its progress plans, together with an enlargement into the Center East, will cement its “place as a world chief” in digital leisure.

So, what does this imply for potential shareholders within the esports firm? Is now a sexy entry level, or ought to they sit tight?

In our NIP Group inventory forecast 2025-2030, we look at the explanations for the hunch, analyse the most recent outcomes, and clarify why its managers stay optimistic.

NIP Group inventory forecast 2025–2026: One-year NIPG inventory projection

Anybody attempting to gauge the place the NIPG inventory worth will likely be in a 12 months’s time received’t be helped by the dearth of inventory market analysts following the corporate.

Which means that the forecasts offered by MarketBeat and TipRanks are every primarily based on the views of just one Wall Road analyst.

MarketBeat, for instance, predicts a 246.82% rise within the NIPG share worth to $6 over the approaching 12 months, which might be an unbelievable consequence for shareholders. Nevertheless, TipRanks is way extra modest in its outlook, with an 11.73% uptick to $2 anticipated over the following 12 months.

In the meantime, the algorithmic forecasts of WalletInvestor are grim studying, as the location predicts the share worth will hunch to zero.

It acknowledged: “In response to our dwell Forecast System, NIP Group Inc. American Depositary Shares inventory is a foul long-term (1-year) funding.”

NIP Group inventory predictions

How in regards to the longer-term NIPG inventory prediction? What are the NIP Group inventory predictions of analysts and algorithmic forecasters for the following 5 years?

As talked about above, an correct NIPG share worth forecast is difficult because of the restricted variety of inventory market analysts carefully following the corporate.

NIP Group inventory forecast 2027–2030: Longer-term prospects

NIPG inventory YTD, one-year & five-year efficiency evaluation

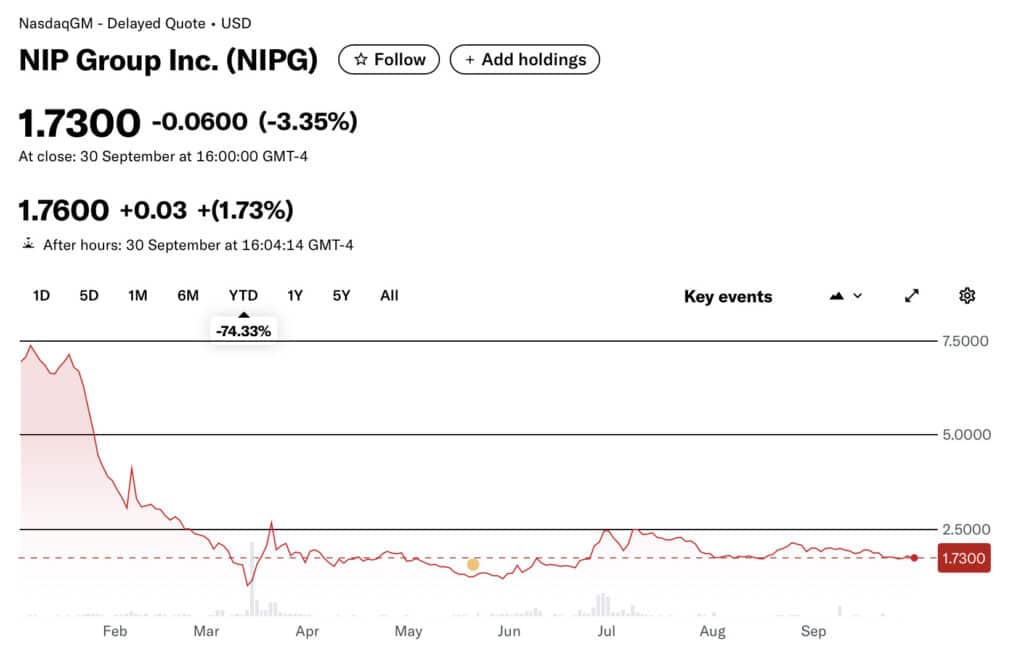

NIP Group inventory year-to-date: -74.33%

The NIPG share worth closed at $1.73 on September 30, 2025. That is virtually 75% under its stage firstly of 2025 and could possibly be partly attributed to the full-year lack of $12.7 million.

NIP Group inventory one-year efficiency: -77.82%

The previous 12 months actually hasn’t been type to the NIPG share worth. The complete-year loss, modest income will increase and considerations in regards to the influence on esports have all contributed.

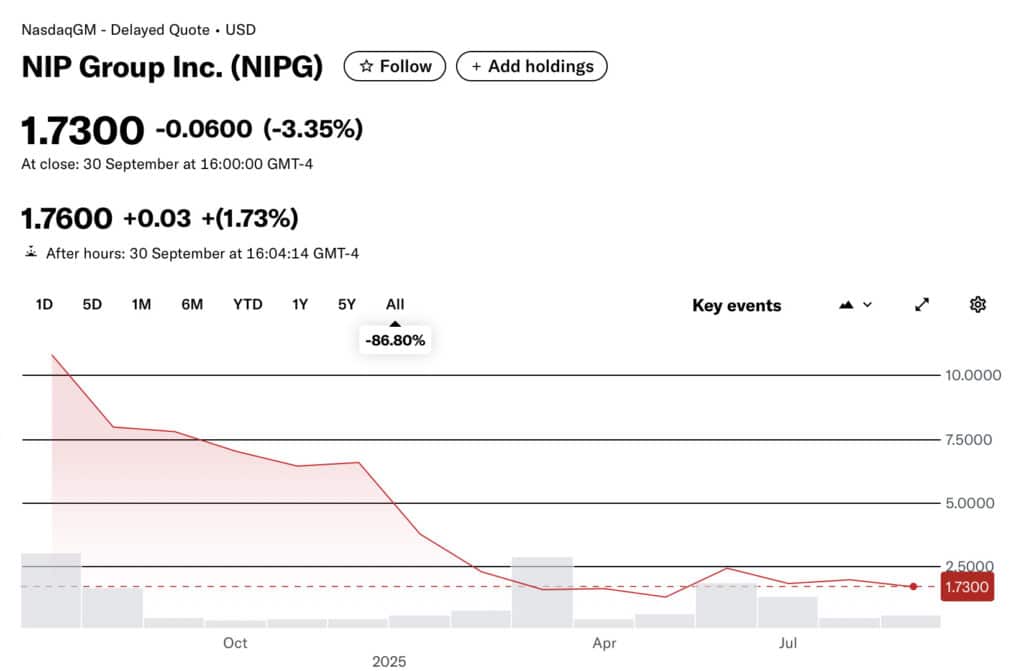

NIP Group all-time efficiency: -86.80%

The NIPG inventory worth doesn’t have a five-year historical past as a result of the flotation solely happened in July 2024. Due to this fact, the all-time evaluation covers 14 months.

The sharp decline from $9 on the IPO to simply $1.73 because the market closed on September 30, 2025, is because of the causes we’ve already highlighted, such because the losses suffered.

Newest earnings outcomes

NIP Group made a $12.7 million loss in full-year 2024, based on its outcomes announcement in late April 2025.

Nevertheless, complete revenues elevated 1.9% year-over-year to $85.3 million, led by a 147.5% enhance in earnings from occasion manufacturing.

Adjusted EBITDA (earnings earlier than curiosity, taxes, depreciation and amortisation) for full-year 2024 was damaging $9.9 million, in contrast with damaging $1.7 million in 2023.

Mario Ho, NIP Group’s chairman and co-chief government, mentioned that though 2024 “examined all the trade”, the corporate maintained modest top-line progress.

He mentioned: “As we proceed to combine our companies and diversify our income streams, occasion manufacturing has turn into a compelling progress engine, with revenues surging 92.6% year-over-year within the second half of the 12 months and greater than doubling for the complete 12 months.”

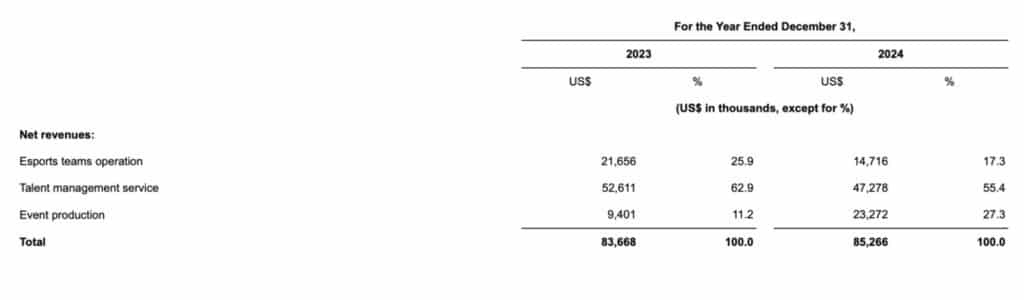

Income breakdown

An evaluation of the corporate’s income sources for 2024 makes for an attention-grabbing learn and highlights disparities between the assorted divisions.

For instance, internet income from esports totalled $14.7 million in full-year 2024, in comparison with $21.7 million within the earlier 12 months.

It acknowledged: “This transformation was primarily as a consequence of a lower in sponsorships and promoting income, primarily associated to the promotion price range adjustment of consumers.”

Expertise administration income additionally declined from $52.6 million to $47.3 million over the identical interval, attributed to the migration from low- to high-performance on-line leisure platforms.

Nevertheless, occasion manufacturing was the large winner, growing by 147.5% from $9.4 million to $23.3 million. “The rise was primarily pushed by the corporate internet hosting a better variety of occasions in 2024, as a consequence of improved integration of inside and exterior sources in the course of the interval,” it famous.

NIP Group outlook: how is the enterprise altering?

The newest outcomes additionally noticed the corporate’s senior administration workforce define its plans for enterprise growth.

In response to Mario Ho, NIP is transitioning from a pure esports organisation into a totally built-in gaming‑centric digital leisure platform.

He mentioned: “We plan to increase our three core companies, whereas additionally introducing new video games and coming into the hospitality market, opening our first S-tier built-in gaming leisure advanced.”

Trying forward, he claimed NIP was well-positioned to develop as a consequence of its progress plans and funding from ADIO, the Guangxi authorities, and the Esports World Cup Basis.

Center East enlargement

NIP secured a five-year settlement with the Abu Dhabi Funding Workplace (ADIO) in January 2025 to drive gaming, media and leisure progress in Abu Dhabi.

The association will see ADIO help NIP with “monetary and non-financial alternatives” valued at as much as $40 million over a four-year interval.

NIP, which is establishing its international headquarters in Abu Dhabi, will contribute to native employment and increase its numerous operations, together with in esports and occasions.

H.E. Badr Al-Olama, director normal of ADIO, mentioned: “ADIO’s partnership with NIP Group displays our shared ambition to guide in progressive industries of the long run on the chopping fringe of leisure and expertise.”

Hicham Chahine, NIP’s co-chief government, believes the transfer into Abu Dhabi provides the corporate entry to a “vibrant, youthful market” that’s rising as a world gaming hub.

He mentioned: “Our entry into the Center East is central to our geographic enlargement and income diversification technique, marking a as soon as‑in‑a‑technology alternative for gaming and esports.”

Trying forward, Chahine emphasised that NIP was assured it was laying the inspiration for harnessing progress alternatives on a world stage.

“I’m assured that this area will drive our subsequent wave of progress and cement NIP Group’s place as a world chief in digital leisure,” he added.

NIP Group enterprise areas

The corporate is made up of a number of manufacturers:

Ninjas in Pyjamas

This was one of many authentic skilled esports groups whose historical past dates again to the early days of Counter-Strike in 2000.

eStar

The 11-year-old eStar Gaming owns a number of sport divisions, together with Honor of Kings, QQ Velocity, Cross Fireplace, and Name of Responsibility.

Expertise company

The eStar Leisure enterprise represents on-line artists, serving to them create and distribute esports and gaming content material throughout numerous platforms.

Magazine Studio

The intention of this enterprise is to concentrate on esports content material manufacturing, masking all the digital sports activities trade.

DragonV

This three way partnership between NIP and Shenzhen Media Group is concerned in occasion planning, content material manufacturing and stadium operations.

Different NIP Group information

Let’s now take into account different NIP Group information that’s been introduced over the previous 12 months.

Crimson Bull partnership

In March 2025, it was introduced that Ninjas in Pyjama had renewed its partnership with Crimson Bull, the power drink model.

The association will embody unique participant content material reminiscent of behind-the-scenes event footage, in addition to Crimson Bull branding within the workforce’s social media and participant jerseys.

In an announcement, Hicham Chahine, NIP Group’s co-chief government, mentioned it had been a pleasure to work with the corporate over the previous two years.

He mentioned: “The extra we work collectively, the clearer it has turn into that we align strongly on values and methods to create significant experiences for our followers.”

What’s the outlook?

So, what’s the conclusion of our NIPG inventory evaluation? Nicely, there’s no denying that traders in NIPG inventory have had a torrid time over the previous 12 months.

The share worth has fallen by greater than 70% as a consequence of substantial losses, regardless of optimistic indicators, reminiscent of a modest income enhance.

Nevertheless, the corporate’s senior administration workforce seems optimistic that its concentrate on the Center East will assist remodel it right into a severe digital leisure participant.

What’s NIP Group?

NIP is a digital leisure group encompassing esports, occasion manufacturing, expertise administration, hospitality and sport publishing.

It was created in January 2023 by way of the merger of ESV5 E-SPORT Group of China and Ninjas in Pyjamas, the Swedish esports organisation, through an fairness share swap.

The corporate, whose employees are break up between workplaces in Sweden, China, Abu Dhabi, and Brazil, trades on the Nasdaq underneath the ticker image NIPG.

Conclusion: Ought to I purchase NIPG inventory?

That is one thing that you just’ll must determine. Nobody can deny that traders have been by way of a really difficult time; the query is, what occurs subsequent?

If NIP’s concentrate on the Center East proves profitable, then the present $1.73 inventory worth might look low-cost with the advantage of hindsight.

The approaching 12 months, subsequently, is prone to be essential, and potential traders will likely be looking forward to the corporate’s subsequent set of outcomes with curiosity.

Buying and selling carries monetary threat and might result in losses. At all times conduct your personal evaluation and by no means make investments greater than you may afford to lose.

FAQs

Is NIPG inventory a great purchase?

You’ll need to reply this query primarily based on the opinions of inventory market analysts and your personal opinions. Keep in mind that even skilled traders could make errors. Your NIPG share worth forecast ought to take into account current information movement, the corporate’s feedback, and the views of the broader market.

What’s the worth prediction for NIP Group in 2025?

Only a few inventory market analysts comply with the corporate, making correct predictions tough.MarketBeat predicts a 246.82% rise within the NIPG share worth to $6 over the following 12 months, whereas TipRanks expects a extra modest 11.736% enhance to $2.

Is NIPG inventory overvalued?

That is one thing you’ll must determine. The inventory has fallen by greater than 70% in 2025, however our NIP Group inventory forecast highlights the optimistic outlook of its senior administration workforce.

What’s NIP Group?

It’s a digital leisure group that encompasses esports, occasion manufacturing, expertise administration, hospitality and sport publishing.

References

NIP Group (NIPG) Inventory Forecast and Worth Goal 2025 (MarketBeat)

NIP Group Inc. Sponsored ADR (NIPG) Inventory Forecast & Worth Goal (TipRanks)

NIP Group Inc. American Depositary Shares Inventory Forecast: all the way down to 0.000001 USD? (WalletInvestor)

NIP Group Inc. (NIPG) inventory worth, information, quote and historical past (yahoo!finance)

NIP Group Inc. Proclaims Closing of its Preliminary Public Providing and Partial Train of Underwriters’ Choice to Buy Further ADSs (NIP Group)

NIP Group Inc. Experiences Second Half and Full Yr 2024 Unaudited Monetary Outcomes (NIP Group)

NIP Group companions with Abu Dhabi Funding Workplace to speed up Abu Dhabi’s esports trade (NIP Group)

Ninjas in Pyjamas Take Flight with Renewed Crimson Bull Partnership (NIP Group)

ESV5 Completes Merger with Ninjas in Pyjamas, Accelerated Globalization Course of (ACN Newswire)

The publish NIP Group inventory forecast 2025-2030: Will the NIPG share worth proceed falling or can traders count on a turnaround in fortunes? appeared first on Esports Insider.