TL;DR

GameSquare Holdings is enterprise a restructuring and has launched an Ethereum-based treasury technique.

The corporate owns FaZe Clan, which runs distinguished groups competing in video games corresponding to Fortnite, Rocket League and FIFA.

GAME inventory is rated a ‘reasonable purchase’, in line with the views of 4 Wall Avenue analysts, compiled by MarketBeat, as of October 8, 2025.

The consensus view is that the GAME share value might rise by 270.83% to $3 over the approaching yr to October 2025.

GameSquare’s traders are understood to incorporate Jerry Jones, who owns the Dallas Cowboys.

It’s been a busy yr for GameSquare Holdings. The proprietor of the FaZe esports workforce has been busy turning itself right into a digital-led leisure firm.

This has concerned a restructuring to streamline prices, the divestment of its remaining stake in FaZe Media, and the formation of a strategic alliance with GGTech Leisure.

The US-based enterprise has additionally launched an Ethereum-based treasury technique, which it hopes will improve its monetary flexibility. The overhaul has helped push the inventory value up 15.4% over the previous yr to $0.81, as of the market shut on October 7, 2025.

In our GAME inventory forecast for 2025-2030, we look at the corporate’s technique, its most up-to-date outcomes, and the predictions of analysts.

GameSquare Holdings inventory forecast 2025–2026: One-year GAME inventory projection

GAME inventory is rated a ‘reasonable purchase’, in line with the views of 4 Wall Avenue analysts compiled by MarketBeat. Two have it down as a ‘purchase’, one as a ‘robust purchase’, and one as a ‘promote’.

The consensus view is that the inventory might hit $3 over the subsequent 12 months. This might signify a 270.83% enhance over the $0.81 closing value on October 7, 2025.

Elsewhere, the views of two analysts compiled by Tip Ranks give a extra modest 12-month forecast of a 116.32% rise to $1.75. It, too, has the inventory down as a ‘reasonable purchase’.

In the meantime, the algorithmic forecasts of Pockets Investor don’t share the optimistic outlook, predicting the GAME inventory value will fall to zero.

It said: “In keeping with our dwell Forecast System, GameSquare Holdings Inc. inventory is a foul long-term (one-year) funding.”

GameSquare Holdings inventory predictions

How in regards to the longer-term GAME inventory prediction? What are the GameSquare Holdings inventory predictions of analysts and algorithmic forecasters for the subsequent 5 years?

Analysts are typically reluctant to supply long-term share value forecasts as a result of there are such a lot of potential variables if you’re trying a number of years forward.

Nevertheless, Pockets Investor’s GameSquare Holdings share value forecast predicts the inventory will stay flat at zero over the subsequent 5 years.

GameSquare Holdings inventory forecast 2027–2030: Longer-term prospects

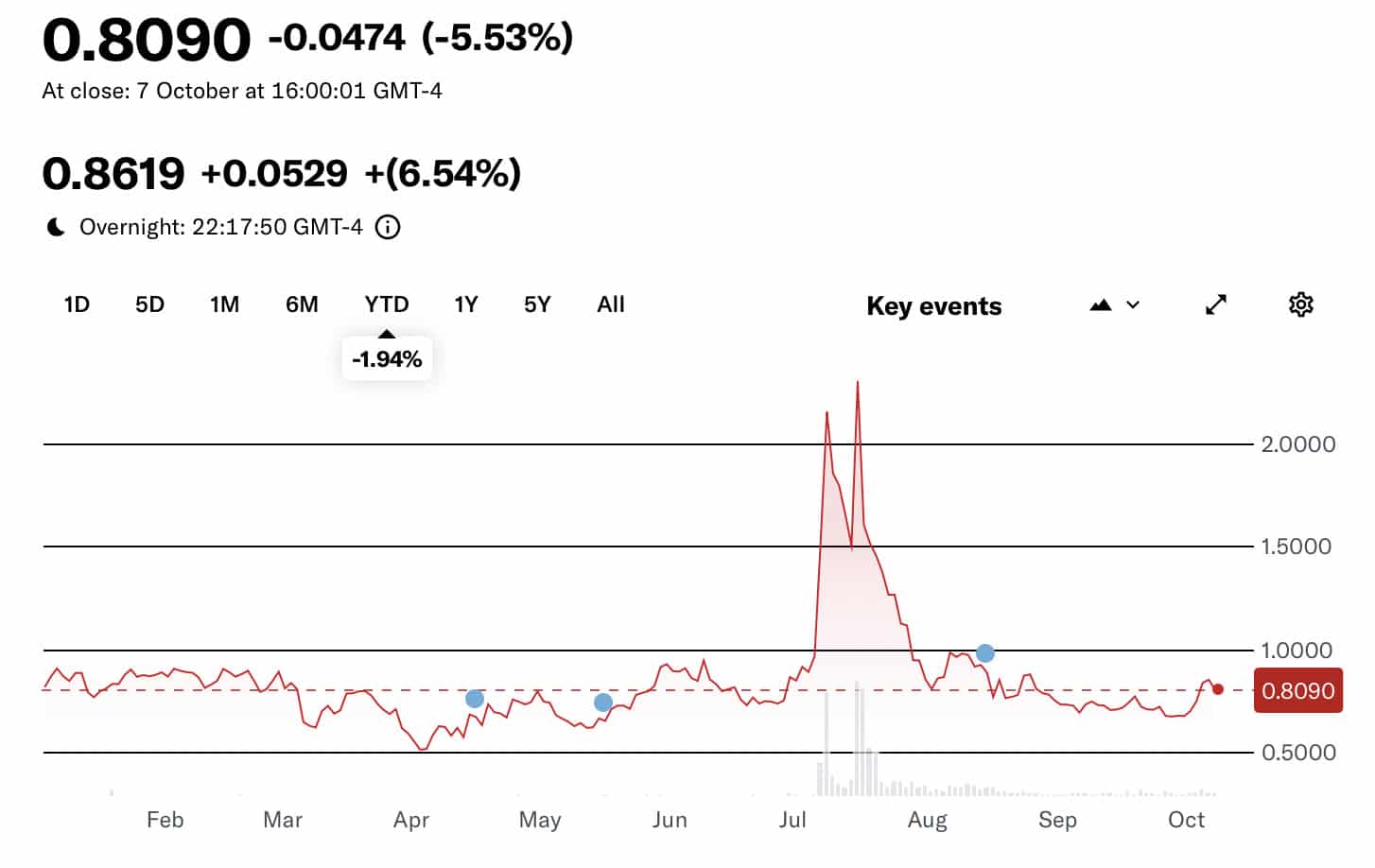

GAME inventory YTD, one-year & five-year efficiency evaluation

GAME inventory year-to-date: -1.94%

The GAME share value has endured a reasonably unstable experience this yr.

There was a very sharp enhance in July, when its Ethereum treasury technique was revealed, earlier than the inventory returned to buying and selling round its extra ordinary stage.

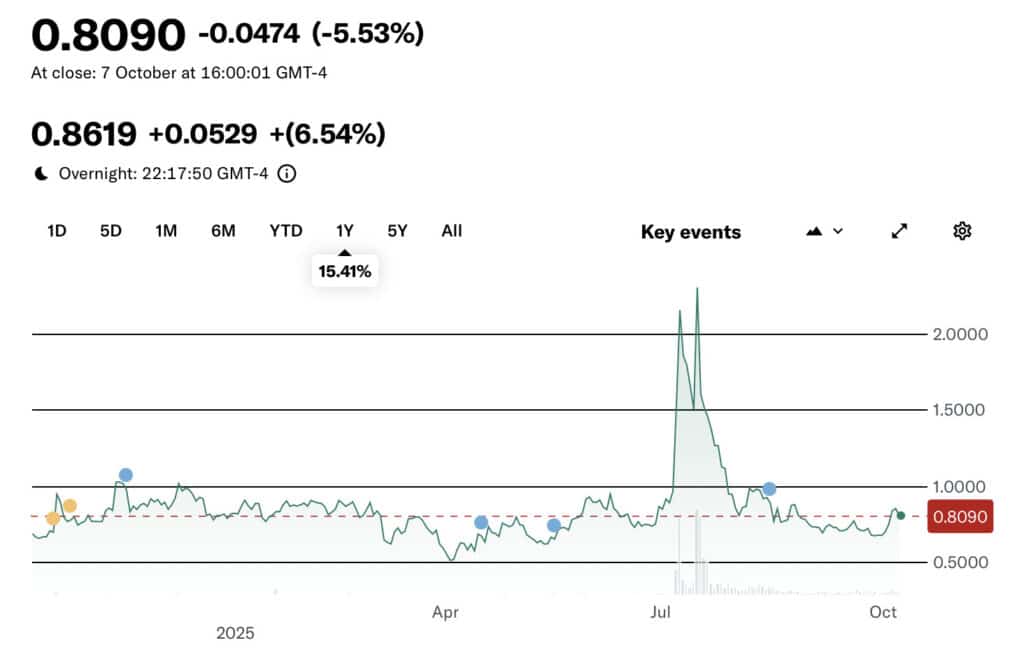

GAME inventory one-year efficiency: +15.41%

A big restructuring, quarterly losses and swings in sentiment have all influenced the GAME share value over the previous 12 months.

This has resulted within the inventory value having elevated 15.41% to $0.81 because the inventory market closed on October 7, 2025.

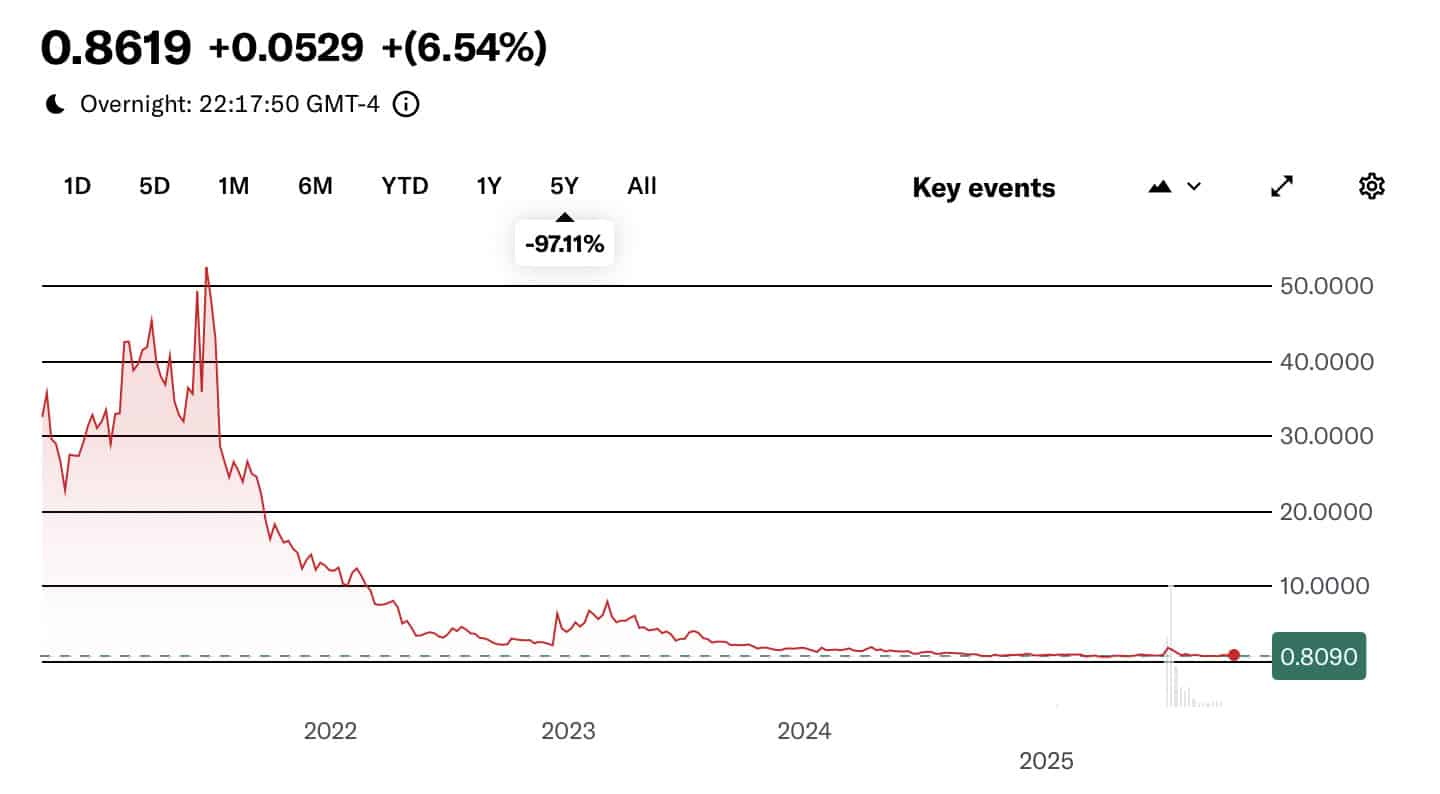

GAME inventory five-year efficiency: -97.11%

The inventory value fall seems to be dramatic but it surely’s deceptive to contemplate the five-year efficiency of the GAME ticker, because the enterprise has undergone mergers and acquisitions.

For instance, in early April 2023, the corporate (then referred to as Engine Gaming and Media) accomplished a plan of association that noticed it purchase the issued shares of GameSquare Esports.

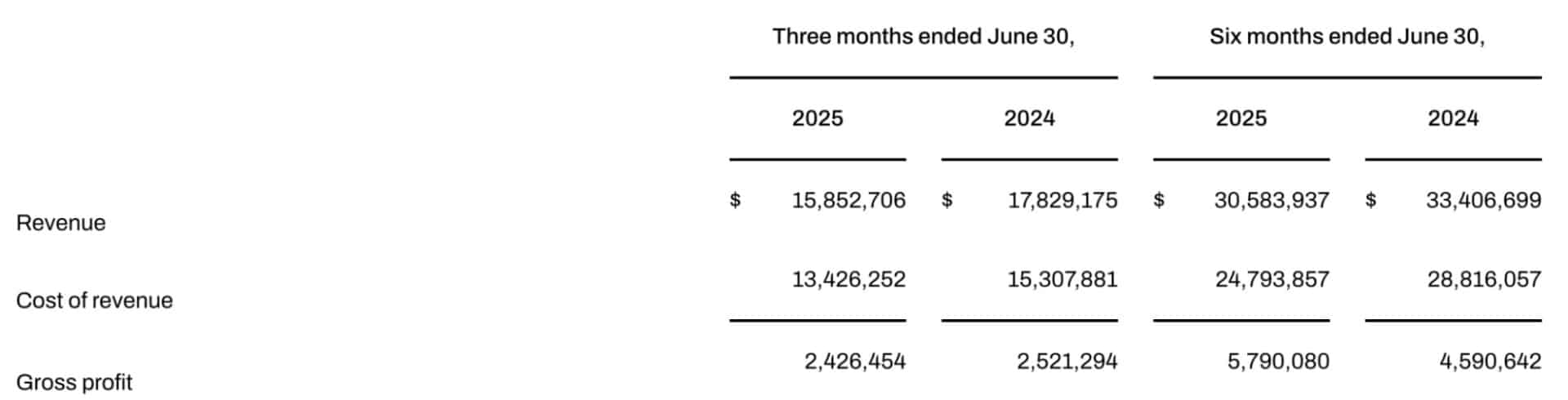

Newest earnings outcomes

GameSquare revealed second-quarter income of $15.8 million, representing a considerable fall from $17.8 million within the corresponding interval final yr.

In an earnings name, chief monetary officer Michael Munoz mentioned: “The 11% year-over-year decline in income was primarily attributable to a discount in programmatic promoting income, partially offset by development throughout our different enterprise segments.”

The corporate additionally reported an adjusted quarterly EBITDA (earnings earlier than curiosity, tax, depreciation and amortisation) lack of $3.5 million.

Nevertheless, this was an enchancment over the $4.2 million loss for a similar interval final yr, which might be partly attributed to value financial savings.

GameSquare restructuring

In keeping with Justin Kenna, GameSquare’s chief government, 2025 is on observe to be a “transformative yr” for the corporate because it builds a digital-first platform.

In a press release, he highlighted the restructuring to streamline prices, the divestment of its stake in FaZe Media, and the strategic alliance with GGTech Leisure.

He mentioned: “Within the second half of the yr, we’re centered on attaining profitability, benefiting from core income development, improved gross margin, decrease working bills, and the affect of our restructuring initiatives.”

He additionally identified that the corporate had doubled down on high-growth areas throughout its Experiences, Managed Companies, and Expertise enterprise models.

Ethereum-based treasury technique

In July 2025, GameSquare launched “one of the crucial refined” Ethereum-based treasury methods in the marketplace, following months of planning.

It said that the association was backed by crypto trade pioneers, together with Ryan Zurrer of Dialectic, Robert Leshner of Superstate, and Rhydon Lee of Goff Capital.

In keeping with Justin Kenna, GameSquare is within the “strongest monetary place” in its historical past, with the pliability to spend money on development, generate yield from our crypto property, and repurchase its inventory.

“We consider the mix of our progressive onchain technique and the bettering efficiency of our working companies positions GameSquare as a robust platform for long-term worth creation,” he added.

GameSquare’s enterprise areas

The corporate operates throughout 4 areas:

SaaS and managed companies

Company and media

Owned and operated IP

FaZe Clan Esports.

GameSquare’s esports operations

GameSquare turned one of many largest gaming and esports organisations, primarily based on viewers attain, after finishing its merger with FaZe in March 2024.

FaZe Clan was based in 2010 by a bunch of gaming fans who turned their ardour right into a profitable profession path.

Its esports division consists of 9 aggressive groups in Fortnite, FIFA, PUBG, PUBG Cellular, Rainbow Six, Name of Responsibility League (Atlanta FaZe), Rocket League, VALORANT and CS:GO.

Through the second quarter of this yr, GameSquare bought the remaining 25.5% of its stake in FaZe Media again to its founders. It retains management of the FaZe Clan.

GameSquare Holdings Information

FaZe Clan sponsorship

In late September 2025, GameSquare introduced the growth of its multi-million-dollar esports sponsorship cope with Rollbit, an internet gaming firm.

The expanded phrases of the settlement will see Rollbit enhance its backing of FaZe Clan’s Counter-Strike workforce from $1.75 million to $3.25 million in annual income.

The workforce’s jerseys will even function the Rollbit brand within the centre patch place in what the corporate believes is among the most distinguished model placements in world esports.

Sam Norman, Head of Partnerships at Rollbit, mentioned: “Since our preliminary deal in 2024, FaZe Clan has constantly delivered unmatched attain and engagement, serving to Rollbit join with one of the crucial dynamic audiences in digital leisure.”

What’s the outlook?

A key conclusion from our GAME inventory evaluation is to look at what the longer term holds for the corporate over the subsequent few years.

GameSquare’s administration workforce believes that the restructuring to streamline operations will speed up the trail to profitability and plans to reintroduce full-year steerage within the third quarter.

It believes ends in the second half of 2025 might be pushed by:

Unrealised Ethereum positive aspects

Core income to be generated

Progress supported by new wins and growth

Affect of restructuring

Unrealised Ethereum positive aspects

As of August 13, 2025, the corporate said that it had roughly $19.3 million in unrealised positive aspects on its Ethereum holdings.

Core income to be generated

Roughly 60% of core income is anticipated to be generated within the second half of the yr, in keeping with typical season tendencies.

Progress supported by new wins and growth

GameSquare expects significant sequential development, with third-quarter income larger than the second and fourth constructing additional, supported by new wins and growth with current companions.

Affect of restructuring

Ongoing initiatives are anticipated to decrease working bills. The corporate has additionally recognized a further $5 million in annualised financial savings.

Sadly, nobody has a crystal ball, so any predictions made by inventory market analysts must be thought to be information-based opinions.

The consensus view from analysts is that the inventory might rise considerably over the approaching yr because the enterprise continues to restructure and scale back prices.

Nevertheless, it’s value mentioning that such share will increase are amplified by the truth that every share trades at lower than $1.

What’s GameSquare Holdings?

It’s a US-based digital media and expertise firm that helps manufacturers and recreation publishers join with hard-to-reach Gen Z, Gen Alpha and Millennial audiences.

GameSquare’s platform offers advertising and marketing and inventive companies to its model companions, in addition to knowledge and analytical options.

FaZe Clan Esports, for instance, is among the “most distinguished and influential” gaming organisations on the planet, in line with the corporate.

GameSquare is traded on the Nasdaq below the ticker: GAME. Its largest traders are understood to incorporate Jerry Jones, who owns the Dallas Cowboys.

Conclusion: Ought to I purchase GameSquare Holdings inventory?

Whether or not or not you can purchase into GameSquare Holdings will rely in your view of the inventory and the opinions of analysts.

The GAME share value has risen over the previous yr attributable to a mixture of its restructuring programme and price reductions.

The consensus view amongst Wall Avenue analysts is that additional will increase could also be seen over the subsequent 12 months, though there’s no assure they’re right.

The conclusion of our GameSquare Holdings inventory forecast is that rather a lot is dependent upon the success of the corporate’s technique.

Buying and selling carries monetary threat and may result in losses. At all times conduct your personal evaluation and by no means make investments greater than you possibly can afford to lose.

FAQs

Is GameSquare Holdings inventory a superb purchase?

You have to to reply this query primarily based on the opinions of inventory market analysts and your personal opinions. Keep in mind that even skilled traders could make errors. Your GAME share value forecast ought to think about latest information move, feedback from the corporate and views of the broader market.

What’s the value prediction for GameSquare Holdings in 2025?

Opinions are divided. In keeping with WalletInvestor’s algorithmic forecast, the GAME share value is anticipated to fall to zero over the subsequent 12 months. Nevertheless, the consensus view of 4 analysts compiled by MarketBeat is for shares to be buying and selling at $3 in a yr’s time.

Is GameSquare Holdings inventory overvalued?

That is one thing you’ll must resolve. The inventory has risen by 15.41% in 2025, however the consensus view of 4 analysts compiled by MarketBeat is for shares to be buying and selling at $3 in a yr’s time. This might signify a rise of round 270%.

What’s GameSquare Holdings?

It’s a US-based digital media and expertise firm that helps manufacturers and recreation publishers join with hard-to-reach Gen Z, Gen Alpha and Millennial audiences.

REFERENCES

GameSquare (GAME) Inventory Forecast and Worth Goal 2025 (MarketBeat)

GameSquare Holdings (GAME) Worth & Evaluation (TipRanks)

GameSquare Holdings Inventory Forecast, “GAME” Share Worth Prediction Chart (Pockets Investor)

GameSquare Holdings, Inc. (GAME) (yahoo! finance)

GameSquare Publicizes Completion of Association (GameSquare)

GameSquare Holdings Inc. Second Quarter 2025 Outcomes Convention Name Transcript (S28.q4cdn)

GameSquare Holdings Reviews 2025 Second Quarter Outcomes (GameSquare)

GameSquare Publicizes Completion of Faze Clan Acquisition (GameSquare)

GameSquare Publicizes that Rollbit Expands Report FaZe Clan Esports Sponsorship with Multi-Million Greenback Settlement (GameSquare)

The submit GameSquare Holdings inventory forecast 2025-2030: Will the GAME share value enhance over the approaching yr? appeared first on Esports Insider.